The Definitive Guide for Exploring the Differences Between Credit Cards and E-Check Means

Understanding the Basics of E-Check Means: A Comprehensive Guide

E-check, additionally recognized as digital examination, is a repayment approach that makes it possible for individuals and companies to transmit funds digitally from one banking company account to another. This payment procedure has acquired significant attraction in current years due to its advantage and safety and security. In this thorough quick guide, we will discover the basics of e-check means and how it works.

What is an E-Check?

This Is Noteworthy -check is a type of electronic settlement that performs similarly to a traditional newspaper inspection. Instead of actually writing out a inspection and mailing it, an e-check makes use of electronic innovation to transfer funds from one banking company account to another. The method entails inputting the important banking details in to an on-line body or software application program.

How Does an E-Check Work?

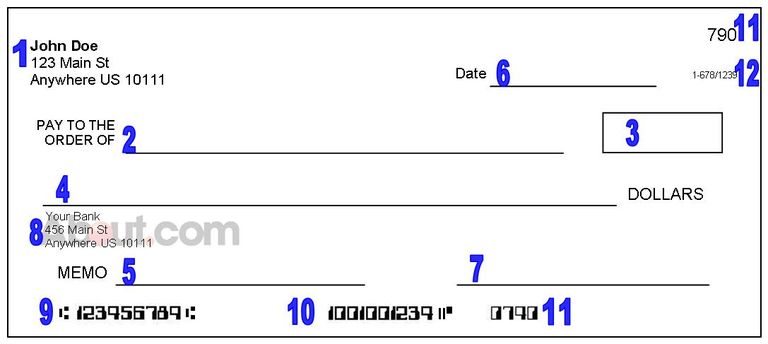

To utilize e-check as a settlement procedure, each gatherings have to have authentic bank accounts with ample funds offered for the purchase. The individual launching the payment must supply their financial institution routing amount and account amount, along with consent for the purchase quantity.

Once this information is inputted in to the device or software plan, it is safely and securely transferred by means of several systems until it arrives at the acquiring celebration's financial institution. The receiving event's financial institution at that point validates that there are sufficient funds readily available and refine the deal appropriately.

The whole entire process usually takes between two to three business days for funds to be moved effectively coming from one profile to another.

Advantages of Utilizing E-Check Means

There are several advantages linked with utilizing e-check means as a remittance technique:

1) Benefit: E-checks may be initiated coming from any type of site with internet get access to at any sort of time of day or evening.

2) Protection: E-checks use safe and secure networks and shield of encryption innovation, creating them much less at risk to scams than standard paper inspections.

3) Rate: Funds may be transmitted more promptly than typical newspaper examinations, removing hold-up times for down payments to clear.

4) Cost-effective: E-checks normally cost less than various other types of digital settlement, such as credit score card purchases.

Disadvantages of Making use of E-Check Means

While there are a lot of perks to utilizing e-check means, there are actually additionally some potential disadvantages:

1) Restricted approval: Not all business approve e-checks as a form of settlement.

2) Delayed processing: E-checks might take longer to refine than other forms of electronic payment, such as credit scores memory card purchases.

3) Improved threat of errors: Suggestionsing the wrong financial info might result in stopped working purchases or wrong funds transactions.

4) No defense versus unapproved purchases: Unlike credit scores cards, e-checks do not use protection versus unapproved deals or illegal task.

Final thought

E-check suggests deliver a practical and secure method for transferring funds online coming from one financial institution profile to another. While there are actually some downsides affiliated along with this repayment procedure, the perks surpass the dangers for many individuals and companies. By understanding the fundamentals of e-check means and how they operate, you may help make informed choices regarding whether it is the right settlement approach for your necessities.